Experience, Knowledge & Personal Attention to Your U.S. Tax Needs

Ameritax Consulting Ltd.

REQUEST A CONSULTATION

How can we help you?

Our Company

We are a cross-border tax practice that was established in 1994 focused solely on US personal income tax consulting and compliance filings. While we have clients across Canada, we serve our predominantly BC-based clientele through offices located in Langley and Nanaimo. We have extensive experience in US federal and state personal income tax preparation, special IRS disclosure provisions, Delinquent Filing Programs and Tax Treaty issues related to Americans resident in Canada, as well as Canadians investing in US real property. As an IRS Certifying Acceptance Agent, we also help individuals obtain US individual taxpayer identification numbers (ITIN) and certifying identification documents.

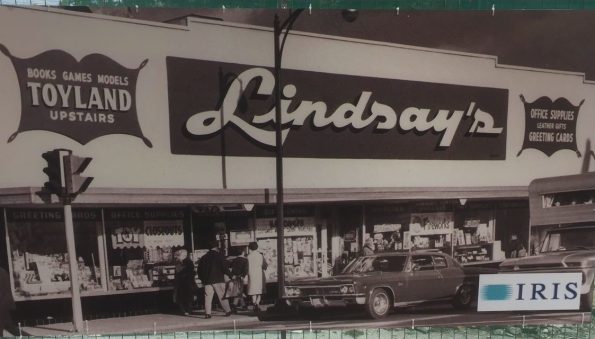

About Doug Lindsay

Director

The ability to communicate complicated US cross-border tax laws in a clear and straightforward manner has been an essential component to building long-term client relationships. Being approachable, along with providing timely service and informed, reasoned advice have also been guiding principles contributing to the longevity of my practice.

Given my focus on US personal income tax compliance and planning for Americans, as well as US filing obligations for Canadian real estate investors, I am able to assist individuals in obtaining IRS tax identification numbers. In this regard, in 1998 I became one of the first IRS approved Certifying Acceptance Agents in British Columbia and have helped hundreds of clients with the US tax identification application process in our Langley and Nanaimo offices.

When I established Ameritax Consulting Ltd. in 1994, I invested time to become a US tax resource for Canadian accounting and service professionals. By developing relationships with banks, CPAs, legal, investment and real estate firms, I have become a trusted and sought out US tax adviser. I have contributed to newspaper business columns, radio spots and financial seminars. It is this technical competence and approachable manner that are particularly valued by clients and professionals alike.

About JoAnne Wilton

Manager

JoAnn has been an integral member of the team since joining the practice in 2010. With over 30 years of experience in accounting and payroll from customer service, training and management, her attention to detail and client-oriented approach has been invaluable. Her role with Ameritax has evolved over the years from an input technician and data compiler, to being responsible for client and prospective client follow up and intermediate tax return review. She is the primary contact in servicing our clients U.S. tax needs and has fostered sincere relationships with many over the years.

During the past 11 years, JoAnn has been a major factor in keeping the practice running smoothly and seamlessly while also prioritizing tasks to meet various client project and government filing deadlines.

Our Services

U.S. Personal Tax Compliance

- IRS Enrolled Agent

- IRS Certifying Acceptance Agent

- Resident, non-resident and dual-status individual IRS federal tax returns

- All states personal tax returns

- FBAR (FinCen 114) filing

- US property rentals & sales by Canadians

- US citizen and green card holder expatriation tax filings

- Offshore Voluntary Disclosure and Streamlined Filing Programs

- US estate & gift tax returns

- US Gambling & Prize Winnings filings for Canadians

- Closer Connection Declarations for Canadian Snowbirds

- Corresponding with the IRS & State Revenue authorities

U.S. Tax Planning

- Special Form Filings for Americans residing in Canada

- Passive Foreign Investment Company (PFIC) Disclosures

- Canadians Owning US real property

- Foreign Bank Account Reporting to the US Treasury

- Information Returns and Reporting of Foreign Trusts

- US-Canada Tax Treaty Application

- US Green Card Holder Filing Matters

Office Locations

Lower Mainland

8047 – 199 Street; Suite 204, Langley, BC

Vancouver Island

– Located in Assante Wealth Management

1200 Princess Royal Avenue; Suite 1, Nanaimo, BC

Mailing address (for both locations)

47 – 20821 Fraser Hwy; Suite 460

Langley, BC V3A 0B6

Contact

Vancouver & Fraser Valley

Nanaimo & Area

Toll Free Phone

Toll Free Fax